Tolu Minerals Ltd. (TOK:ASX) is being upgraded. Tolukuma has been a high-grade (>20g/t mine grade ) mine, with an access road upgrade and construction underway. They seem to be seeking to emulate K92 Mining's 18moz success in Papa New Guinea.

Tolu Minerals is now in full action, carrying out its Prospectus Business Plan.

The company has been supported by team members from the very successful TSX-listed K92 Mining Inc. (KNT:TSX.V) with Ian Stalker (Founder and former CEO of K92) and Chris Muller (current Chief Geologist of K92) on TOK's Advisory Board and TOK seeks to emulate K92's success in increasing gold resources from 1moz to current 18moz and increasing gold output from 130kozpa to ~500kozpa.

Construction work has commenced on upgrading and completing the 71km access road to the mine to allow logistics to be undertaken without the high cost of helicopter transport.

Work Underway To Increase Gold

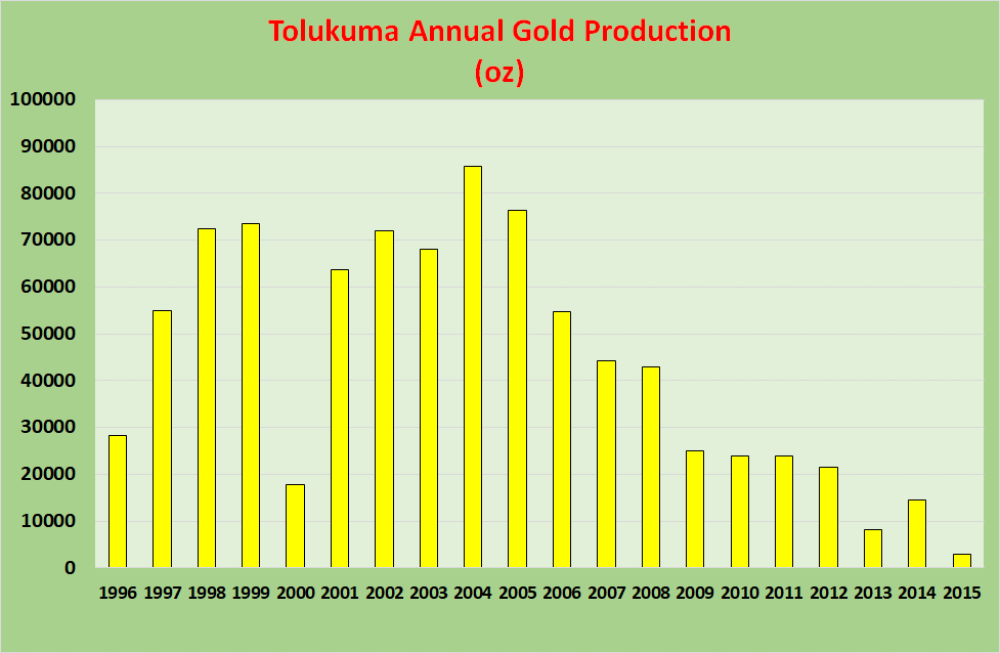

Work is also underway to increase the gold resource and upgrade to Measured and Indicated status in those areas that are immediately accessible near the main portal and also areas such as the Fundoot that will be accessible after about 30m of dewatering. The Tolukuma Gold Mine produced around 1moz at an average grade of 15g/t over 1996-2015 from epithermal veins on the Tolukuma Structure. Production in the first decade was at >20g/t mine grades.

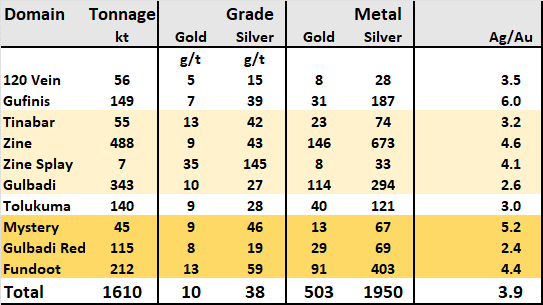

The current JORC Inferred Resource is 503koz at 10 grams per tonne (g/t) from a number of veins adjacent to existing infrastructure.

Tolu Minerals considers that immediate access to those certain areas will allow it to upgrade the resources to Indicated and Measured and to take bulk samples for treatment through the Tolukuma Gold Plant gravity circuit for minor gold production.

Other areas, including the Fundoot Structure, will be accessible after the modest dewatering.

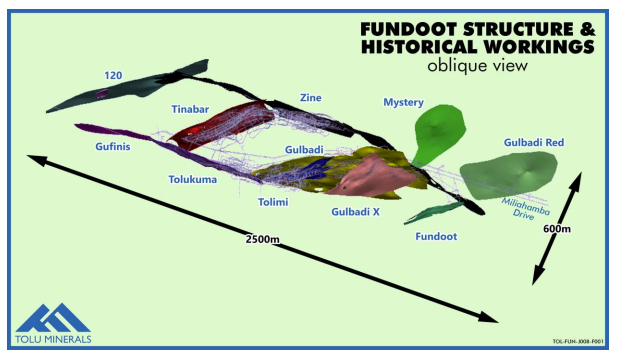

The exploration potential from existing underground development is substantial as the Tolukuma structures are open-ended at depth and along strike, with many having considerable future resource potential at depth and to the south.

The existing Milliahamba Drive and its southward extension will give access to >2moz potential in high-grade epithermal vein gold along >2000m of strike.

Current MRE has 503,000 Ounces Gold

TOK's current Mineral Resource Estimate (MRE) has 503,000 oz Au in an Inferred Mineral Resource category.

- The top zones of certain resources (Tinabar Top, Zine Top, and Gulbadi) are immediately accessible from the main portal

- A lower zone (Fundoot, Gulbadi Red, and Mystery) requires dewatering by about 30m for access to 133koz(26% of MRE).

In the near portal zone, resources in the Tinabar Top, Zine Top, and Gulbadi structures are adjacent to historically mined areas.

These are immediately accessible from the existing main portal by ore development on structure although access to the the bulk of these resources will require later substantial dewatering by the proposed drainage adit.

Tolu will be generating ore from sampling in order to boost resources and resource confidence levels. This material will be fed through the gravity circuit to produce a modest amount of gold.

In the lower zone, the Fundoot, Gulbadi Red, and Mystery veins are totally unmined and will be readily accessible from the existing Miliahamba Drive infrastructure. About 30m vertical dewatering from 1555mRL to 1520mRL is required for access to about 133,000 oz or ~26% of the MRE.

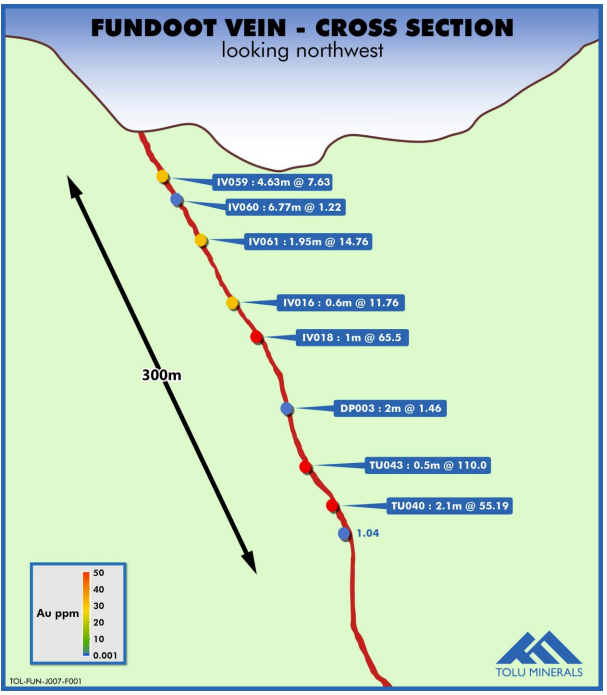

Focus is being placed on the Fundoot structure due to its high grade and near-ready access.

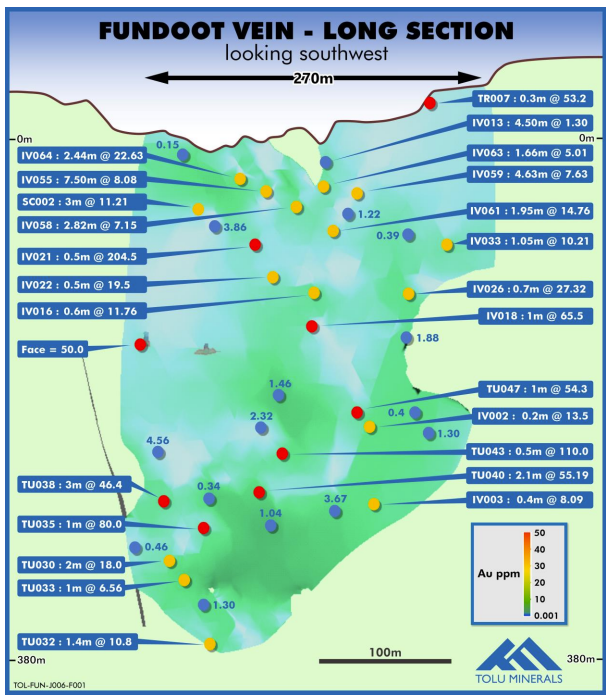

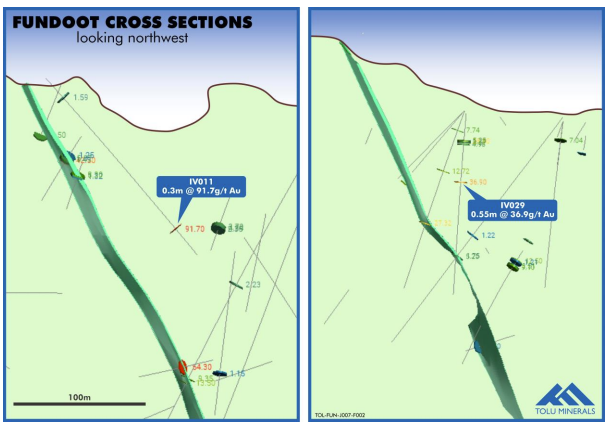

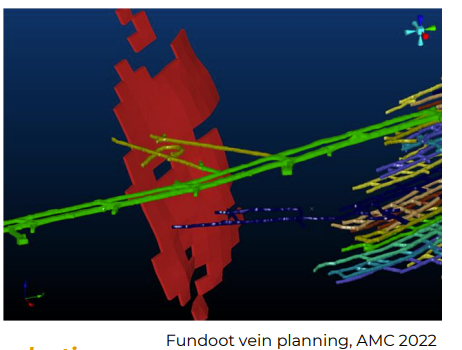

The Fundoot Structure contains 91,000 oz Au at 13g/t Au in an Inferred Mineral Resource category and is immediately South of the historic mine workings. It dips to the Northeast and has bearing Southeast to Northwest.

The vein shows continuity over 380m vertical and 250m along strike. It is open at depth and along strike.

The Fundoot structure is South of and sub-parallel to the highly productive Gulbadi structure that was a mainstay of the mine whilst in full production.

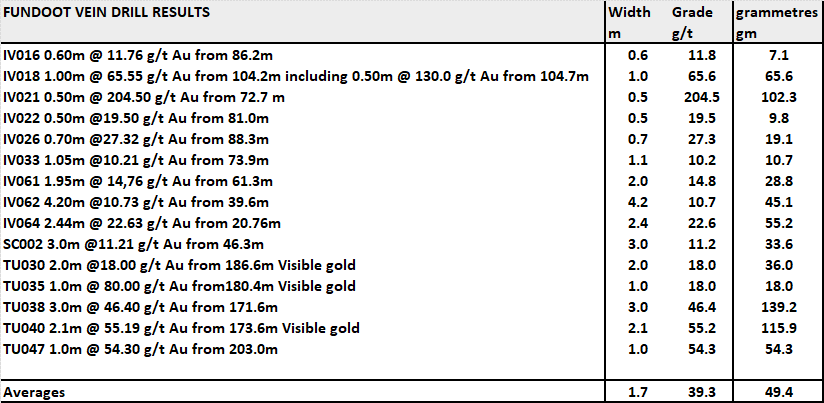

Historic Fundoot drilling covered 45 holes, but average grades from 15 better historic drill holes gave 39.3g/t and up to 204g/t (see table below) to be set against the resource grade of 13g/t.

Vein widths range from less than 1m to over 4.0m, and the average from the 15 drill holes is 1.7m.

The average gram x meter intersection is 49.4.

The resource grade here, as noted, is 13g/t for 91koz .

Additional veins with different orientations have been encountered in the Fundoot hanging wall and could provide additional resources.

The Fundoot structure is already accessible from the Miliahamba Drive with existing development drives.

Vertical extent is >380m and strike 250m and is open in each direction.

The grades and character of the Fundoot structure are typical of the Tolukuma Gold Mine, and TOK's infill drilling and bulk sampling are likely to increase both grade and gold oz.

Production in the first decade at Tolukuma was from mined grades that exceeded 20g/t to produce 60-70 kozpa.

TOK has a 200ktpa mill, hydroelectric power, substantial access development tunneling, and a vast mine-surrounding tenement holding.

The mine will deliver high-grade bulk samples to the mill in 2024 and would be looking at operating gold production soon after.

K92 - Tolu Minerals Analogue

- From 1moz to 18moz gold resources.

- Current 130kozpa producer on the way to ~500kozpa.

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.